Why Should I Invest? Understanding Why Investment Is Important for Your Future

Investing is a smart strategy for anyone who wants to build a better future. In this post, we break down why you should invest, how it helps your money grow over time, and why starting now can give you a serious edge. Whether you’re saving for a dream home, retirement, or just want to stop stressing about money, understanding the power of investment can change everything.

Why Should I Invest-

>> For multiple income streams

Has the question, “Why should I invest?” ever crossed your mind? you’re not alone. Many people feel unsure about where to begin, whether it’s safe, or even if it’s necessary. The truth is that you don’t have to be wealthy to invest; nonetheless, investment is how most people accumulate wealth.

understanding why investment is important isn’t just about making more money – it’s about securing your financial future in a world where the cost of everything keeps rising.

However, there is always a risk associated with every investment, but there can be no profit without risk, and you may easily reduce your risk if you invest sensibly.

Here, we can say that there is a calculated risk in investment, and Investment is not like speculation or gambling, which have always been associated with very high risk.

Learn the differences between investment, speculation and gambling

In this article, we’ll break down the real reasons why investing matters, especially if you want to gain financial freedom, beat inflation, and build peace of mind for your future.

What is the investment?

Before answering why I should invest, let’s get clear on what investing actually is.

Investment is committing your money to an asset and expecting a profit in the future from this investment.

Suppose you buy a property for rs.10, 00,000 and expect that after 5 years it will be sold at approximately rs.20, 00,000 then it’s your property investment and this investment is expected to double in 5 years. However, there is always a risk associated with any investment.

Does it sound like saving? Actually, in investment, you always deploy your funds, and in saving, you store a part of your income without worrying about profit or gain in the future.

Thus, learn how to invest, and if you invest properly, the returns generated in the future can provide you and your family with financial stability.

Factors Which Make Investment Increasingly Important

Longer life expectancy

In today’s world, people are living longer than ever before — and that’s great news. But it also comes with a big financial question: how will you support yourself through those extra years?

When thinking about why I should invest, one of the most practical answers is simple: because you’re likely going to live a longer life, and that life needs to be funded.

Thanks to advances in medicine, healthcare, and overall awareness around wellness, average life expectancy has increased significantly over the past few decades. This implies that you may retire for 20, 30, or even 40 years.

This raises an important point:

Saving alone might not be enough.

Relying solely on a pension or government support? Risky.

With longer lifespans come additional costs that previous generations didn’t face. Healthcare expenses alone can consume a massive portion of retirement income, especially in those later years when medical needs typically increase.

That’s where investment becomes essential.

Here’s why investing early and consistently is a must if you want to thrive, not just survive, later in life:

1. The Danger of Outliving Your Savings

The likelihood of running out of money in retirement is significantly larger if individuals live longer. Investing helps your money grow and last longer, so you don’t have to worry about outliving your funds.

2. Medical Costs Will Keep Rising

Longer life often comes with increased healthcare needs. Investing provides a financial cushion that can help cover unexpected medical expenses, insurance premiums, or long-term care.

3. Social Security or Pension Might Not Be Enough

In many countries, government or employer retirement plans don’t fully cover modern living expenses, especially over a longer lifespan. Investing helps fill that gap.

4. You Deserve to Enjoy Your Later Years

Retirement shouldn’t feel like a downgrade. With the right investments, you can afford travel, hobbies, and comfort, not just necessities. After working hard your whole life, you deserve financial peace and freedom.

You can start with as little as Rs. 2000 per month. Compound returns allow even modest, steady investments to increase dramatically over time. The key is starting as early as possible and staying committed.

Keep in mind that the question is not if you will require money in your later years, but rather how well-prepared you will be for such a need.

Grow your money, The Real Power Behind Investing

If you’ve ever wondered what it really means to “grow your money”, the answer lies in one word: investing.

Whether you’re earning a little or a lot, the truth is the same: money sitting in your savings account is safe, but it’s not growing. To build wealth, prepare for the future, and support a longer life, you need to do more than just save. You need to invest.

Growing your money means putting it into something that has the potential to increase in value over time. Instead of letting your cash sit idle, you allow it to work for you through the power of compounding, dividends, capital appreciation, or interest returns.

This isn’t about getting rich quickly. Instead, it’s about strategically allocating your funds into assets like stocks, bonds, real assets, business or mutual funds, where they have the potential to generate returns. Over the long term, the power of compounding – earning returns on your initial investment and the returns it generates – can significantly grow your money.

Not all investment approaches raise money in the same way or at the same rate. Understanding your options helps you choose strategies that align with your timeline and goals, especially when considering investments for a longer life expectancy.

Learn how much and where to invest.

And when you consider investment for longer life expectancy, the idea of growing your money becomes even more important. You are investing for decades of financial freedom, not just the next five years.

Many people hesitate to try growing their money through investing because they’re worried about risk. Investments can indeed lose value in the short term, but here’s what’s often overlooked: not investing is also risky.

The risk of keeping all your money in “safe” savings accounts is the guaranteed erosion of purchasing power through inflation. Over long periods, this erosion can be more devastating than temporary market downturns.

When planning investment for a longer life expectancy, you actually have an advantage in managing investment risk. With decades until you need the money, you can ride out market volatility and benefit from the stock market’s long-term upward trend.

You can begin expanding your money without becoming rich. All you need is the following:

- A readiness to begin, even with little

- Basic understanding of investment options

- A long-term mindset

Apps, ETFs, and automatic investment plans have made it easier than ever for beginners to get started

To support yourself through rising costs, unexpected life events, and a longer lifespan, you need more than just savings — you need growth.

So, identify where you are and start. Let your money work for you.

If you delay investing means your money has less time to grow.

You can benefit from compound interest’s magic

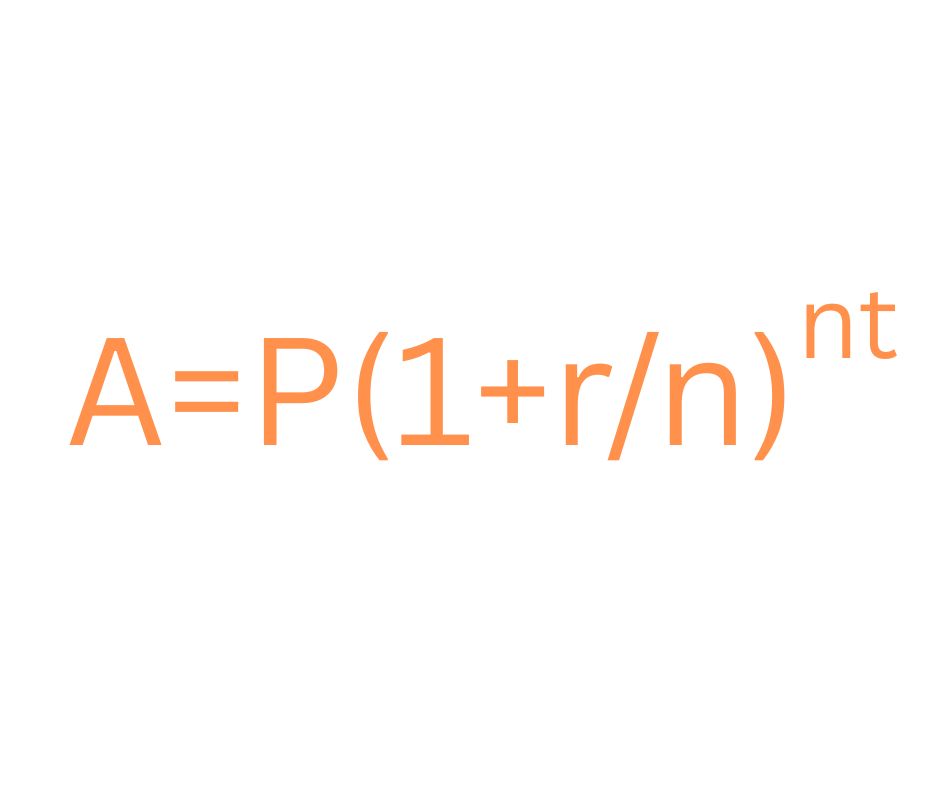

When people talk about growing wealth over time, they often mention a powerful force that makes it all happen — the magic of compound interest. But what exactly is it, and why is it so important in your investing journey?

The magic of compound interest isn’t just a catchy phrase – it’s the fundamental force that transforms modest, regular investments into life-changing wealth over time.

Understanding how compound interest works is one of the biggest reasons why people finally realize why investment is necessary for financial freedom, retirement, and long-term peace of mind.

To put it simply, compound interest is the process of generating interest on both your initial investment and the interest that accrues over time on your initial investment.

Unlike simple interest, which pays you only on your initial amount, compound interest pays on your balance as it builds, month after month, year after year. It’s like Money automatically makes more money.

To truly appreciate the magic of compound interest, let’s start with a simple example that shows how dramatically different compound growth is from simple interest or regular savings.

Imagine you invest 1,000 rupees and earn 10% annually. With simple interest, you’d earn 100 rupees each year forever: year one: $1,100, year two: $1,200, year three: $1,300, and so on. But with compound interest, you earn 10% on your invested amount and interest earned on the invested amount each year.

Here’s how the magic of compound interest transforms that same 1,000 rupees:

- Year 1: 1,100 rupees (earned 100 rupees)

- Year 5: 1,611 rupees (earned 611 rupees total)

- Year 10: 2,594 rupees (earned 1,594 rupees total)

- Year 20: 6,727 rupees (earned 5,727 rupees total)

- Year 30: 17,449 rupees (earned 16,449 rupees total)

Notice how the annual earnings accelerate over time? In year 30, you earn over 1,500 rupees just from that original 1,000-rupee investment. This acceleration is why investment is necessary for anyone serious about building wealth – your money literally works harder each year without any additional effort from you.

Compound interest rewards the early birds. Your money needs time to grow, which you provide by investing early

The magic isn’t really magic – it’s mathematics working in your favour over time. But the results can seem magical when you realize that your money has grown into wealth that seemed impossible when you started. Begin today and let the eighth wonder of the world start working for your financial future.

For achieving your financial targets

Dreams without a plan remain wishes forever. Whether you’re eyeing a comfortable retirement, your child’s college education, or that dream home, every meaningful financial target requires more than just hoping and saving. Investing transforms your goals from distant possibilities into achievable realities by putting time and compound growth on your side.

So, when you ask, “Why should I invest?”, the answer is simple: to achieve your financial target with purpose, power, and a strategy.

A financial target is a specific monetary goal tied to a future need or aspiration. It could be short-term, like building an emergency fund or buying a car, or long-term, like accumulating rupees 1 crore for retirement or creating a legacy fund for your family. Learn more about financial targets.

Whatever your target may be, simply stashing cash in a low-interest savings account probably won’t get you there, at least not efficiently. That’s where investing comes in.

Setting a financial target without considering investment growth severely underestimates what’s possible. If we consider a 10% inflation rate and you need 10,00,000 rupees today for a specific goal, then after 15 years, you would need 4177248 rupees. Saving alone requires setting aside rupees 23200 monthly, approximately. However, investing that same amount in diversified funds earning 10% annually means you only need to contribute approximately rupees 10400 monthly. savings of rupees 12800, approximately, each month while still reaching your target. This difference becomes even more dramatic with longer timeframes

By aligning your investment strategy with your financial target, you give yourself the best shot at achieving what truly matters to you, without unnecessary detours or delays.

It’s easy to dream big regarding a brighter financial future. But hope without action rarely produces results. Investing serves as a link between your current situation and your desired outcome. It turns hazy ideas into measurable progress.

So, next time when “why” arises regarding investing, think of your goals. Your dream, the place where you want to live, or how you will live in your older age. Then remember this: your financial target is achievable—but only if you give your money the chance to grow.

Beat Inflation

If you’ve ever felt like your paycheck isn’t going as far as it used to, you’re not imagining it. Prices are rising, from groceries to gas to healthcare. That steady increase in prices over time? That’s inflation. And due to this inflation, you’re quietly losing purchasing power.

That’s why understanding how to beat inflation is so important — and why investment is necessary if you want to stay ahead financially.

Inflation is like a slow leak in your wallet—every year, the money you save buys less than it did before. If you’re wondering “how to beat the inflation”, the answer is simple: you must invest. Keeping cash under your savings account means losing purchasing power over time. Here’s why investing isn’t just a wealth-building tool—it’s a financial survival strategy in an inflationary world.

Investing allows your money to work for you. Assets like stocks, mutual funds, ETFs, real estate, and even inflation-protected bonds often generate returns that exceed the average inflation rate. For example, the historical average annual return of the stock market has hovered around 7-10% after adjusting for inflation, significantly higher than most savings accounts or fixed deposits.

Here’s how to beat inflation through investing:

- Diversify Your Portfolio: Spreading your investments across various asset classes helps reduce risk while aiming for higher returns.

- Invest in avenues which are not affected by inflation, such as gold, silver, or real estate

- Invest for the Long Term: Markets may fluctuate in the short run, but a long-term strategy helps ride out volatility and compound return over time.

- Reinvest Earnings: Whether it’s dividends or capital gains, reinvesting can exponentially increase your total returns.

Every month you delay investing is another month inflation chips away at your financial future. Begin small, stay persistent, and watch as your money works harder than inflation can.

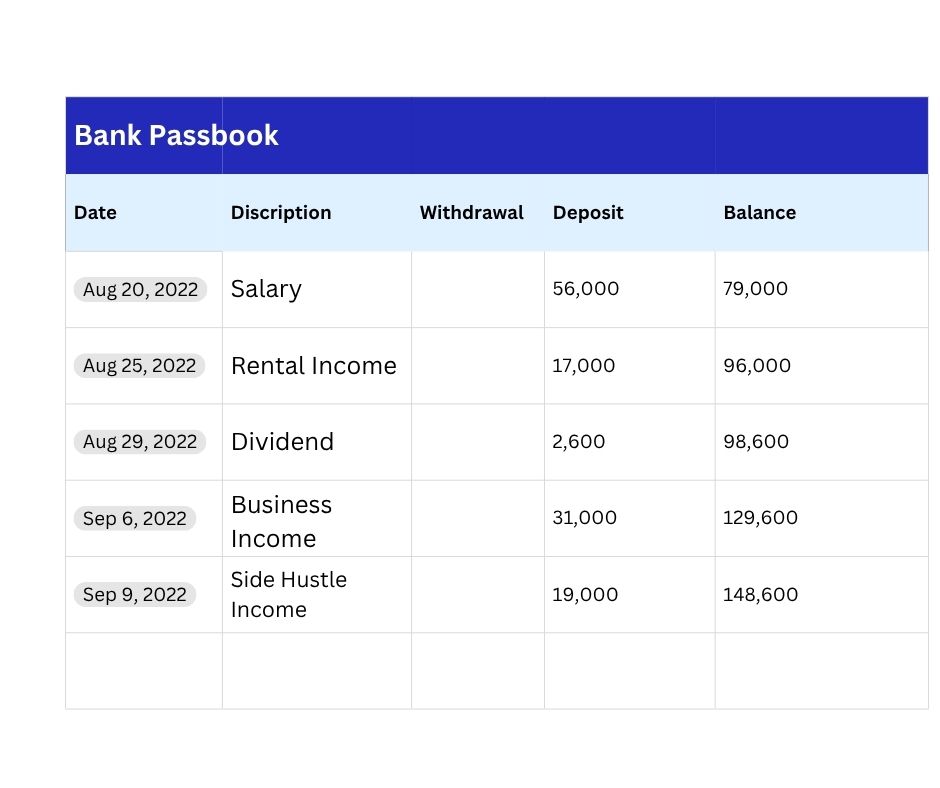

For Creating Multiple Income Streams

Imagine waking up and checking your bank account—not just for your paycheck, but to see dividends from stocks, rental income, or profits from a small business you invested in. That’s the power of having a multiple-income stream strategy. It’s not just a financial buzzword, it’s a smart, future-focused way to build wealth and security in an unpredictable world.

So, why should I invest? One of the most compelling reasons is to create more than one way for money to flow into your life. Relying solely on a single paycheck is risky, especially when unexpected expenses or job changes come knocking. Investing opens the door to additional income sources that can support your goals, reduce financial stress, and provide more freedom.

A multiple income stream approach transforms your financial landscape from fragile to resilient. Instead of depending entirely on your 9-to-5 job, you create various revenue channels that work independently of each other. When one stream faces challenges, others continue flowing, maintaining your financial stability.

Think of it like a river system. A single stream can dry up during drought, but multiple tributaries feeding into your financial river ensure water keeps flowing regardless of seasonal changes. This diversification principle applies perfectly to income generation through strategic investing. Here are a few examples:

- Dividends from Stocks: Earn a portion of a company’s profits by holding dividend-paying stocks.

- Real Estate Investments: Rental properties can provide steady monthly cash flow.

- REITs and Crowdfunding: Real estate exposure without the hands-on work of being a landlord.

- Side Business Investments: Partner in a startup or small business for potential long-term returns.

The journey to establishing multiple income streams begins with a single investment. Whether you start with 1000 rupees in a dividend-focused exchange-traded fund or 1,00,000 in Real estate, the key is beginning the process. Each stream you create today becomes stronger tomorrow through reinvestment and compound growth.

Remember that developing several sources of income needs patience and persistence. Your first dividend payment might only buy a cup of coffee, but with time and reinvestment, those small streams can grow into rivers of financial independence.

Tax Efficiency

When it comes to building wealth, tax efficiency has a crucial role in your arsenal. Simply put, tax efficiency is the art of minimizing the amount of taxes you pay on your investments, allowing you to keep more of your hard-earned money.

So, why should I invest? Beyond growing your wealth, investing gives you powerful opportunities to be strategic with your taxes.

Different types of investments are taxed differently, and certain accounts offer tax advantages that can make a big impact over time. Thus, tax efficiency means manage your investment efficiently so your overall tax liability reduces.

Various retirement funds, or ELSS, can save a lot of tax, and index funds and exchange-traded funds (ETFs) offer superior tax efficiency compared to actively managed mutual funds. Unnecessary taxes can hinder your financial growth year after year. That’s why tax efficiency isn’t just for wealthy investors or accountants, it’s a practical strategy for anyone looking to make their money go further.

Tax efficiency is not flashy, but it’s incredibly effective. Combine it with other reasons like beating inflation or creating multiple income streams, and the answer to “why should I invest?” becomes crystal clear: to grow smarter, not just faster.

Let Your Money Work For You

The idea behind learning how to make your money work for you is smart work in the place of hard work. Instead of trading every hour of your life for a paycheck, you start building wealth that grows, even when you’re not actively earning it.

One of the most empowering reasons to “why should I invest” is to break free from the cycle of earning and spending, and to build a financial system that works for you, not just because of you.

Making your money work means putting your savings into investments that generate income, appreciate in value, or both. It’s the opposite of letting your cash sit idle in a low-interest account, slowly losing value to inflation. Imagine having thousands of employees working for you 24 hours a day, seven days a week, never taking sick leave or vacation time. That’s exactly what happens when you understand how to make your money work for you through smart investing. Each dollar you invest becomes like hiring a dedicated worker whose only job is generating more money.

Here’s how your money can works for you through smart investing:

- Invest in the Stock Market: Over time, the stock market has historically delivered strong returns. You don’t need to be an expert—index funds and ETFs make it easy to start.

- Generate Passive Income: Real estate, dividend stocks, or peer-to-peer lending can produce regular income with minimal effort once set up.

- Compound Your Growth: Reinvesting earnings leads to compounding, where your gains start generating their gains—building wealth faster.

- Automate and Diversify: Set up automatic contributions to a diversified portfolio. Your money grows behind the scenes, day in and day out.

The sooner you begin teaching your money how to work, the more time it has to develop valuable skills and build wealth. Even starting with 2000 rupees monthly in a low-cost index fund puts your money to work immediately. That small amount might seem insignificant, but it represents the beginning of a powerful wealth-building system.

Learn how to invest, and you can find that you do not need a large amount to invest.

most brokerages now offer zero-minimum investment accounts, meaning you can begin putting your money to work with whatever amount you have available today.

Your money can work for you and increase your wealth or works against you and eroded by inflation—there’s no neutral position. Inflation constantly works against cash sitting in checking accounts and actually lose purchasing power over time. By learning how to make your money work for you through strategic investing, you transform every dollar from a passive bystander into an active wealth-building partner that works tirelessly toward your financial goals.

Build Financial Freedom

What if your daily choices weren’t dictated by money? Imagine waking up and you do not have any financial burden like unpaid bills or debts. You have a secure future, and lot of time to live your life on your own terms. That’s the essence of what it means to build financial freedom—and it’s one of the most powerful reasons to start investing today. investing isn’t just about chasing returns—it’s about creating a life where money becomes a tool, not a limitation.

Financial freedom (independence) Is about choice. The choice to retire early, travel more, start a passion project, or simply live life on your own terms. It will happen when you have enough savings, investments and income streams. It is the state where your investment income covers your living expenses without requiring active work. Active work means you work because you want to, not because you have to. If you have time to live your life on your own terms its means you have achieve financial freedom

But achieving that level of freedom doesn’t happen by accident. It requires intentional planning, and investing plays a central role in that journey.

When you invest regularly and wisely, you build a foundation that supports your future self, so you’re not working forever, just to make ends meet.

Financial experts often refer to the 4% rule as a guideline for achieving financial independence. If you withdraw four percent of your investment every year for your livelihood then also your principal amount will not deplete. Using this framework, building financial freedom requires accumulating 25 times your annual expenses in invested assets.

If your annual living expenses total 10 lac rupees, you’d need approximately 2.5 crore rupees invested to achieve complete financial freedom. While this might seem daunting initially, breaking it down into manageable monthly investment goals makes it surprisingly achievable over time.

The path to financial freedom has only three possible routes: inherit wealth, build a highly successful business, or invest systematically over time. For most people, investing represents the most realistic and accessible path to true financial independence.

It’s easy to delay investing. Life gets busy, and the financial world can feel overwhelming. But every day you wait is a missed opportunity to grow your freedom fund. If your goal is to build financial freedom, the best time to start is today.

The answer to “Why should I invest?” It isn’t just about your finances, it’s about time, energy and how you want to live your life. With the right investments, financial freedom isn’t just possible, it’s within reach.

Protecting Against Economic Uncertainty

Life is unpredictable—and so is the economy. From market crashes to global pandemics, recessions to rising interest rates, we’ve seen how quickly things can shift. This is exactly why smart financial planning should include strategies for protecting against economic uncertainty.

One compelling reason for “why should I invest” is simple: to prepare for the unexpected and build resilience in uncertain times.

Economic means you cannot predict anything about finances of you or the whole world. Your job, stability of financial market, inflation rates and overall economic condition which affects you directly or indirectly. It can stem from political events, global conflicts, natural disasters, or even shifts in consumer behaviour. And when it hits, it often affects job security, savings, and the cost of living all at once.

Economic uncertainty manifests in countless ways that directly impact your financial well-being. Job markets can shift overnight, entire industries can become obsolete, and currency values can fluctuate dramatically. The 2008 financial crisis, the 2020 pandemic shutdown, and recent inflation surges demonstrate how quickly economic conditions can change, often catching people completely unprepared.

In a world where change is the only constant, relying solely on a salary or savings account can leave you financially vulnerable. That’s where investing steps in—not just to grow your money, but to shield it.

Here’s how investing can act as a buffer against economic uncertainty:

- Diversified Portfolios Spread Risk: Investing across different asset classes—stocks, bonds, real estate, and even commodities—reduces your exposure to any one market downturn.

- Certain Assets Perform Better During Crises: Defensive stocks, gold, and inflation-protected securities can hold or even increase value during turbulent times.

- Long-Term Investing Builds Stability: While markets may dip short-term, they have historically trended upward over time. If you can stay in dip you may get better result in long term.

- Cash Flow from Investments: Passive income from dividends or rental properties can offer financial cushioning when job income is unstable.

By investing wisely, you’re building a financial defence system—one that can support you through market swings, job transitions, or unexpected life events.

So, why should I invest? Because doing nothing you are on risk also. Investing helps you turn uncertainty into opportunity. It allows you to survive economic storms and come out stronger.

The Opportunity Cost of Cash

Keeping a pile of cash tucked away in a savings account may feel safe, but in the long run, it can quietly cost you more than you think. That’s because every penny sitting idle is a penny not working for you. This hidden downside is known as opportunity cost, and it’s one of the most overlooked reasons why investing is essential.

Value you miss when you choose a particular choice.

In simple terms, opportunity cost is the Value you missed when you make a particular choice. When it comes to money, that means every dollar you don’t invest could have been earning you returns somewhere else.

Let’s say you leave 10,000 rupees in a traditional savings account earning 3% interest, while the stock market averages around 7% annually over the long term.it means you will lose tens of thousands in near future by choosing traditional saving account over investing in stock market. That’s the real cost—not in rupees lost, but in rupees never earned.

There’s nothing wrong with keeping some cash for emergencies. But beyond that, letting your money sit untouched in a low-interest account means you’re sacrificing future potential for short-term comfort.

The opportunity cost works against you with-

- Inflation: it decreases your purchasing power over time.

- Low Returns: Savings accounts and CDs typically offer minimal interest, far below what you could earn by investing.

- Missed Compounding: If you do not invest then you will not get benefits of compound growth

Wealth need time to grow. Early birds take most of the benefits from investment. Choosing not to invest or wait for the “right time” means losing out on years of potential gains.

So, why should I invest? The opportunity cost of waiting, hoarding cash, or staying on the sidelines adds up more than most people realize. Investing wisely allows your money to work for you, rather than sitting stagnant while inflation chips away at its value.

It’s all about balance. Keep enough cash to cover emergencies and short-term needs—but beyond that, let your money grow. Whether it’s through stocks, bonds, real estate, or index funds, putting your money to work helps you make the most of your financial future.

Remember, doing nothing with your money is still a decision, and often, it’s the costliest one.

At its core, the question “why should I invest?” for your growth financially and individually.

From beating inflation and building multiple income streams to achieving tax efficiency and reaching your financial targets, investing is the vehicle that takes you from surviving to thriving. It empowers you to let your money work for you, build financial freedom, and prepare for economic uncertainty—all while avoiding the hidden opportunity cost of letting your cash sit idle.

Investing is for anyone with a goal, a plan, and the courage to think long term. Whether you’re just starting or looking to grow what you’ve already built, investing gives your money purpose and potential.

So, don’t wait for the “perfect time.” The best time to invest is when you realize that your future deserves more than hope—it deserves action.

Start small. Stay consistent. Invest with intention. Because when you do, you’re not just growing your wealth—you’re building a life of freedom, choice, and financial security.

One Comment