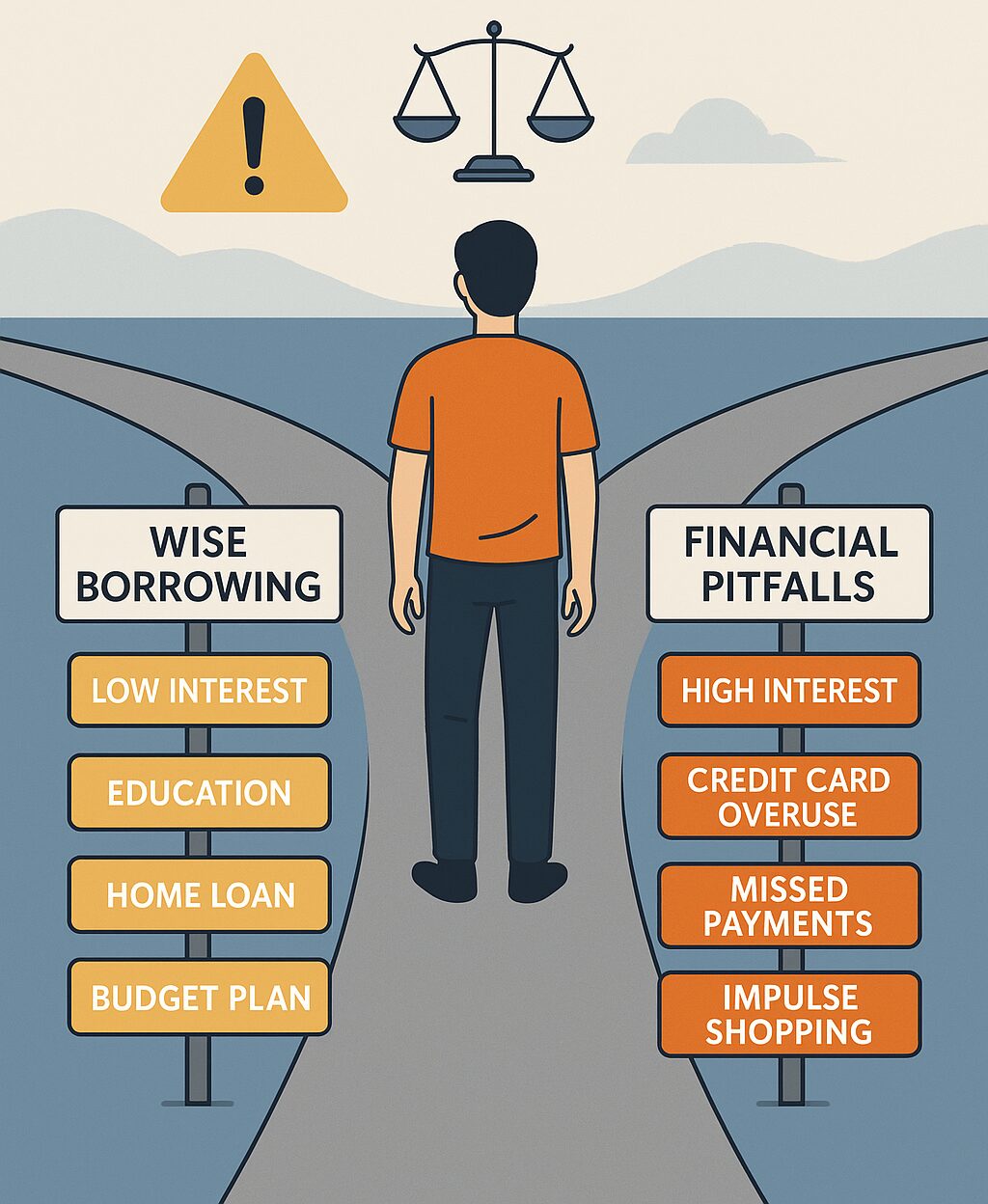

Debt is not the enemy — misusing it is. In today’s world, borrowing is almost unavoidable, whether it’s for buying a home, funding education, or handling emergencies. The key is knowing how to borrow smartly so it works for you, not against you. This guide explains debt in simple terms, reveals the difference between good and bad borrowing, and shares proven tips to avoid costly mistakes. By understanding interest rates, repayment strategies, and your real borrowing limits, you can turn debt into a stepping stone toward financial growth instead of a trap that holds you back.

How to Reverse Lifestyle Creep: Journey towards Financial Transformation

Lifestyle creep happens quietly—one upgrade at a time—until your spending rises to match your income. Reversing it isn’t about cutting all joys, but about realigning your money with what truly matters. This journey is about taking back control, making intentional choices, and building a future of financial freedom—one smart step at a time.

Why Should I Invest? Understanding Why Investment Is Important for Your Future

Investing is a smart strategy for anyone who wants to build a better future. In this post, we break down why you should invest, how it helps your money grow over time, and why starting now can give you a serious edge. Whether you’re saving for a dream home, retirement, or just want to stop stressing about money, understanding the power of investment can change everything.

Is investment also speculation or gambling?

At first glance, investing seems like the responsible opposite of gambling. But when you’re buying stocks on a hunch or chasing crypto trends without real research, the line gets blurry. Is it still investing—or just dressed-up speculation? Maybe the difference isn’t what you’re doing, but why and how you’re doing it.

The Power of Anchoring Bias: Why Your Starting Point Steers Your Choices

Think your choices are totally rational? Think again. Anchoring bias means the first number or idea you see can quietly steer every decision after it. From prices to opinions, your starting point has more power than you realize—and it’s time to take back control.

Lifestyle Inflation or Lifestyle Creep: Why Earning More Can Leave You with Less

Lifestyle creep happens when higher income leads to higher spending, often without noticing. Learn what it is, how to spot the signs, and simple ways to avoid falling into the trap.

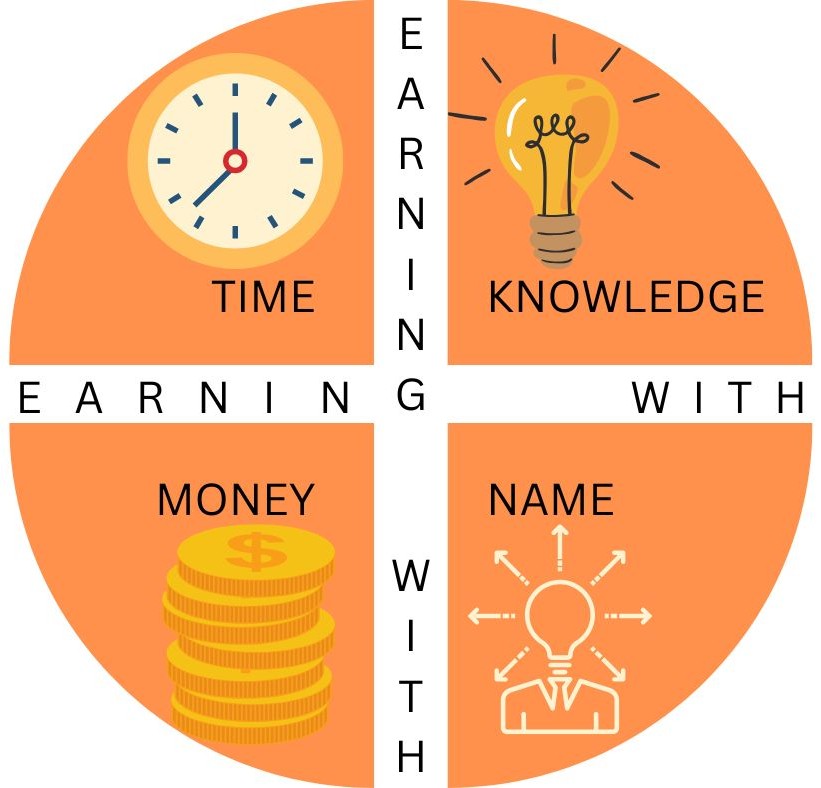

The Wealth Quadrant: a journey to financial growth

We all start somewhere—maybe with a part-time job in high school or a side hustle born from passion. But as we move through life, our understanding of money evolves. The Wealth Quadrant isn’t just a concept; it’s a map of personal financial growth, showing how we shift from trading time for money to building sustainable income streams that work for us. This post takes you on that journey—from the grind of earning a paycheck to discovering investments, ownership, and ultimately, freedom as wealth and bliss. Whether you’re just getting started or levelling up, this is your invitation to step into a new mindset around money. It’s not just about getting rich—it’s about getting wise.

Identify, where you are!

Identifying your financial position is the first step towards achieving your goals. Are you aware of your current savings, debts, and investments? Understanding where you stand financially can empower you to make informed decisions and create a roadmap for your future

Your journey to financial clarity starts here!

How to earn more!

Want to increase your income but not sure where to start? Whether you’re looking to negotiate a raise, start a side hustle, or invest wisely, there are countless ways to grow your earnings. In this post, we’ll break down practical strategies—from improving your skills to leveraging passive income streams—that can help you take control of your financial future.

Just begin where you are…

Just begin where you are… It’s never too late to take control of your financial future. Every journey starts with a single step. Whether you’re planning for retirement, saving for a major purchase, or simply looking to improve your financial literacy, the first step is always crucial and navigating the complexities of finance. Discover how we can start our journey!