Lifestyle Inflation or Lifestyle Creep: Why Earning More Can Leave You with Less

Lifestyle creep happens when higher income leads to higher spending, often without noticing. Learn what it is, how to spot the signs, and simple ways to avoid falling into the trap.

Lifestyle Creep-

Once, American historian and philosopher Mr. Will Durant said,

“We are what we repeatedly do. Excellence, then, is not an act, but a habit.”

Thus,

We develop a habit by doing an act repeatedly, which affects us.

It may affect us badly or in a good way.

The interesting thing about those habits is that we do not realize we have developed a habit.

Lifestyle creep or lifestyle inflation is also a habit that a person develops gradually and very soon affects their financial decisions.

Before making any decision, we must know what lifestyle creep or lifestyle inflation is.

Your lifestyle is how you live your day-to-day life and how you spend money on it. Your home, your food, your clothes, your vacation, or anything you use in your day-to-day life. Lifestyle creep or lifestyle inflation occurs when you increase your spending on your standard of living with increments in your earnings, and gradually, it all becomes a necessity.

Such as spending money on the interior of your home, eating out, or wearing more expensive brands of clothes.

It is not only about spending more money, but it is about developing a habit.

This is a habit that you do not realize because it develops with your income increments, and it happens very slowly. Gradationally, you assume that all is your necessity.

Such as frequently eating out or getting food delivered at home or the office.

But when your income increases, you are spending more, so what is the problem?

Everyone is earning money for a better lifestyle and spending it accordingly.

Is Lifestyle Creep or Lifestyle Inflation Really Bad?

What are the dangers of “lifestyle creep”? how “lifestyle inflation” can affect you?

Your hard work increases the inflow of money and tends to make a few changes in your lifestyle.

The more money that flows in, so it’s inevitable to stop the outflow of money.

And here the dangers of lifestyle creep start, when we are unable to stop that outflow.

And our repeated actions change our habits.

Assume that you got a promotion and got an increment as well.

Now, with the extra amount you receive, if you celebrate with your friends or family, then it is okay, but if you start eating out weekly and gradually develop a habit, then it is bad.

The problem is not celebrating your success or spending money for a better lifestyle, but creating a habit that can harm your financial health in adverse circumstances.

Now, because you are habitually eating out weekly, you have also started getting food delivered to your home or office frequently.

Thus, you develop a habit, and this habit will affect your long-term financial goals.

This habit that you develop will be called “lifestyle creep” or “lifestyle inflation” because all these lifestyle updates happen with your income increments and gradual changes in habits.

It Could Be

· Having so many OTT subscriptions that you do not use.

· Buying electronic items like a smartphone or a new laptop without need.

· Buying stuff online frequently that you do not need.

· Spend so much money on a hobby such as traveling or gardening.

· Spending money on home interior unnecessarily

· Frequently eating out or getting food delivered to your home

In lifestyle creep or lifestyle inflation, you develop habits that may be influenced by others’ lifestyles and are not your necessity.

The other drawback of this lifestyle creep is that you are not able to enjoy it because you do not realize that you have developed a habit.

Assume that you are getting food delivered so frequently that you have become habitual of this, and then it will not be so enjoyable because it will be routine.

Or suppose you have many OTT subscriptions but are unable to enjoy all of them because of a lack of time.

Or you may have a mobile phone in good condition, but under the influence of someone, you have bought a new phone with the same working capacity.

In the above examples, we develop a habit because we have some extra income and do not enjoy it. Or we are influenced by others and get extra things we already have.

We can see many people with these habits in our workplaces or homes. Many of them even think that they are special and have the right to have all their habits.

But the main drawback is that it can prevent you from saving and affect your long-term financial goals. And if this happens, then it is really bad.

Suppose a person started his first job.

Now, he has started buying things that were not within his reach previously, such as a recently launched new iPhone model.

He bought it only because his colleagues have the same model. Now he can pay EMI for this, and with excitement, he ordered this mobile phone.

However, in this case, he may deviate from his long-term goals, such as buying his first home or paying down his student debts.

Here we unintentionally adopt a lifestyle we can’t afford.

And this new lifestyle always hinders us from reaching our long-term targets.

Once we adopt a higher-class lifestyle, it is very difficult to revert to a simpler lifestyle. Because we have made an identity according to this lifestyle in society. We have friends, colleagues, and other surrounding people who have the same lifestyle. All surroundings hinder us from reverting and lead us to financial disaster.

Here, under pressure to keep up, indiscipline takes place in our financial decisions. We take risks where our spending surpasses our income.

Unfortunately, it’s very difficult to revert, but not inevitable.

The lifestyle creep trap, how it happens…

For better understanding, we take an example.

There is a hypothetical character named “James.”

James is working in a shopping mall as a salesman and earns approximately 10000 rupees per month. He is also preparing for some competitive exams.

He daily meets various types of customers and knows very well the standard of living of higher-earning people groups and their habits and ways of spending.

He also wants to earn money and spend like them but also knows the importance of saving, and he saves Rs/- 2000 per month and invests in mutual funds.

As usual, he is also using various social media platforms, is aware of various lifestyle products, and is also under the influence of various social media influencers.

Now, one day he cleared a competitive examination and got a “Sarkari Naukri” or “government job.” And his earnings increased from rupees 10000/- a month to rupees 40000/- a month.

Now he has more money to spend and to save, and he tries to spend more like the other higher-earning people.

Simultaneously, he also got the offer of a reputable credit card and a shopping card, which was recommended by his colleagues. He takes both, and now he spends money through his cards.

But now, after 6 months, he realizes that he has a 50000 rupee debt on his credit card, a personal loan of 50000 rupees, and no savings except 20000 rupees in mutual funds.

How did it all happen? Actually, James developed some habits with his income increase, and now these habits are his necessities, such as buying branded clothes, using Ola or Uber in place of public transport, or eating fast food regularly. He also developed a habit of shopping regularly through various online shops because he has some tempting offers on some online shop portals and also on his shopping card.

Like this, lifestyle creep or lifestyle inflation works. It is a story about which many people can relate to themselves.

Here, after an increment in income, James should have more savings and a good amount of investment, but he has debts.

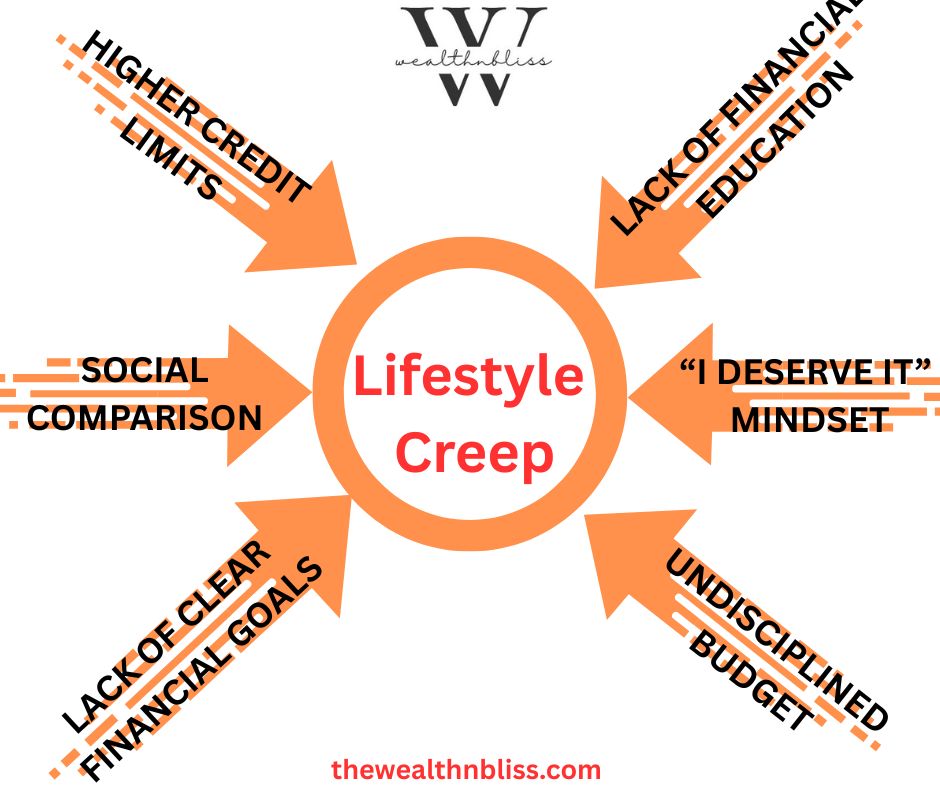

Cause of lifestyle creep…

Why did it all happen? There is not a single reason, and not only you have been trapped.

But there are so many factors that lead you to spend money on your wants rather than your needs.

1. Social comparison

Nowadays, every person has a presence on social media and is aware of every trend. In the above example, James is influenced by his colleagues, friends, and relatives of higher earning capacity and tries to follow their lifestyle. But he forgets that he has only a limited source of income. On social media, an abundance of information is available, and anyone can have unrealistic expectations.

2. Lack of Clear Financial Goals

Without clear financial goals, it’s easy to lose sight of what’s important and spend money on things that don’t align with your long-term priorities. In the above example, James doesn’t have a specific savings target or retirement plan; he is more likely to splurge on luxuries instead of saving or investing the extra income. Lifestyle creep thrives in the absence of purpose-driven financial decisions.

3. Enjoyment of current consumption

It is very difficult for anyone to resist the enjoyment of current consumption, even though we all know the importance of saving for tomorrow. We all prefer to enjoy the smaller rewards daily rather than long-term goals. And that all smaller rewards change habits and lead to “lifestyle creep.”

4. The “I Deserve It” Mindset

When you work hard and earn more, it’s natural to feel like you deserve to reward yourself. James did work hard and got his desired job. Developing the mindset “I deserve it” is natural after success. But treating yourself occasionally is fine; this mindset can spiral out of control if left unchecked. Small indulgences—like dining out more often or upgrading your gadgets—can quickly add up, leading to significant increases in your overall spending.

5. Higher credit limits

Nowadays, getting a higher credit limit is so easy and has also become a status symbol, and by your credit limit, you can try to live beyond your assets. In the above example, James got a credit card because his colleagues have the same. His advanced credit limit leads him to unnecessary expenses.

6. Anchoring bias

It is a mortal tendency that relies on the first piece of information we receive in making a decision. This first piece of information becomes a reference point when we receive other information, and we always compare other information with this reference point.

Suppose we have to buy a gift for our friend and have a budget of 500 rupees.

We found a gift that costs 1000 rupees, which is over budget.

Now we have found another gift costing 700 rupees, which is also over budget.

But we bought this second gift because we found it comparatively cheaper than the first choice. That anchoring bias leads us to lifestyle inflation.

7. Undisciplined budget

There is also a tendency to neglect budgeting when a person earns more. An undisciplined budget leads to “impulse buying” and exacerbates to “lifestyle creep.”

8. Lack of Financial Education

Many people simply aren’t taught how to manage their money effectively. Without a solid understanding of budgeting, saving, and investing, it’s easy to fall into the trap of lifestyle creep. James is well educated but may not be financially educated. Financial literacy is key to making informed decisions and avoiding unnecessary spending.

Signs of lifestyle creep: how to identify it.

Earlyrecognition of lifestyle creep is key to preventing financial strain. But how to identify whether you are enjoying the fruits of your hard work or going to adopt a new and expensive lifestyle?

Here are some signs to watch out for and how you can keep them in check.

· Your income is increasing, but your savings are stagnant. Compare your previous year’s income with your current year’s income and try to find out, compared to your current savings, how much savings should be increased according to your savings plan.

· If you are not able to control your finances. You always feel that you do not know where your income goes.

· If you’ve gotten a raise or started earning more but still feel like you’re struggling to make ends meet, it’s a major sign that lifestyle creep has set in.

· You have credit card debt. You are relying on credit cards to get through the months.

· If you have started borrowing money from others to pay your bills or for emergency expenses

· If you notice that fixed asset costs are steadily increasing (moving to a pricier apartment, adding more streaming services, or upgrading your cable package), it could be a sign that lifestyle creep is at play.

· If you feel comfortable paying high overdraft fees and penalties.

· If you find it difficult to maintain your emergency fund, or it is gradually draining.

Only you can know the true situation, whether you are facing lifestyle creep or not. The above signs depend on individual situations.

Suppose you have an emergency; then, obviously, your emergency fund will decrease.

Or maybe you have borrowed from your relatives or friends to pay an inevitable fee for the education of your children.

You will have to find your priorities in your life, but you should always have a plan to succeed financially.

Lifestyle creep doesn’t happen overnight; it’s a gradual process that can quietly undermine your financial health. If you recognize the signs early, you can take actions to curb spending that is not necessary and stay on track with your targets.

How to avoid lifestyle creep

The first step in dealing with lifestyle inflation or lifestyle creep is recognizing it.

We aim to ensure that we do not miss out on the pleasures of life. We all have successes in life and must enjoy them with friends and family. But make sure that we are not prone to lifestyle creep.

Here are some possible ways to avoid lifestyle creep:

· Set clear financial goals.

Your financial goals should be very clear, as these motivate you to adopt savings habits. Whether you have to build your own house or buy a car, the education of your children or your retirement goal, these should all be clear in terms of time and amount. Your habit of overspending always loses the battle with your clear vision.

· Make a budget and stick to your budget.

Making a budget is a great way to combat inflation creep. Keeping a budget allows you to track changes in your spending pattern, increments in your earnings, and how much you are saving.

Additionally, it shows how your savings coincide with the objectives you have set. If you find any discrepancy in your budget according to your long-term goal, then immediately take steps to resolve it.

Having a budget is vital, but following it is even more important.

Review your budget each month and try to find a loophole in your budget. Make changes in the budget according to your needs.

· Automate your savings.

Setting automatic payments to your savings funds is a great way to control overspending. Make different savings funds according to your needs, such as a retirement fund, home loan EMI, children’s education, etc., and regularly contribute to these funds with your earnings. This enables you to prioritize saving over unnecessary expenditures.

· Increase savings with each raise.

As soon as you receive a bonus, raise, or other unforeseen income, set aside a portion of it for savings.

Make a rule about how much you will save from your earnings and stick to it; then, with the remaining amount, you spend on your own.

If you get an increase in earnings, then review your budget and raise each portion of the budget. Of course, it is about managing your spending habits well and not hindering you from enjoying life.

In this way, you will not fall into the trap of lifestyle creep and enjoy your successes as well.

· Identify the spending triggers.

Only you can identify your weak points where you cannot control your spending.

You may be influenced by a social media influencer or maybe making a comparison of yourself with your friend or a colleague and making spending decisions accordingly.

Make a coordinated effort to identify and address the triggers that cause an inclination to spend.

· Practice delayed gratification.

On financial success, an impulse to celebrate it with friends or family is instinct, and everyone wants it. But in a hurry, this celebration can lead you to spend unnecessarily. Maybe this success is not as big as you are enjoying, or maybe you are spending a lot on this celebration.

In this situation, you can delay the celebration of your success. This gives you time to adjust to your new income and decide how you really want to use it. In this way, you can evaluate your successes, and you will have time to think about how you can celebrate this success better in terms of financially and emotionally.

· Avoid lifestyle comparison.

In the age of social media, we all compare ourselves with others. These comparisons encourage us to spend more on our lifestyle. And we try to follow others’ vacations, purchases, and lifestyle upgrades. But people only show highlights of their success and not their struggles.

Everyone’s financial situation and goals are completely different. You should not spend money in the same way that your friend or colleague is spending. Always keep your spending under control and schedule your entertainment appropriately.

Avoiding lifestyle creep doesn’t mean you have to live like a monk or deny yourself every indulgence. It involves making deliberate decisions that are consistent with your principles and objectives. By staying intentional with your spending, prioritizing savings, and focusing on what truly brings you joy, you can enjoy the benefits of your hard work without falling into the trap of endless consumption. After all, the best things in life— financial security, meaningful experiences, and the WEALTH N BLISS —aren’t things you can buy.

1 Reply to “Lifestyle Inflation or Lifestyle Creep: Why Earning More Can Leave You with Less”