The Wealth Quadrant: A Journey to Financial Growth

We all start somewhere—maybe with a part-time job in high school or a side hustle born from passion. But as we move through life, our understanding of money evolves. The Wealth Quadrant isn’t just a concept; it’s a map of personal financial growth, showing how we shift from trading time for money to building sustainable income streams that work for us. This post takes you on that journey—from the grind of earning a paycheck to discovering investments, ownership, and ultimately, freedom as wealth and bliss. Whether you’re just getting started or levelling up, this is your invitation to step into a new mindset around money. It’s not just about getting rich—it’s about getting wise.

The Wealth Quadrant

Earning money is a fundamental aspect of life, but the way we earn it evolves as we grow personally and professionally. Whether you are just starting your journey to lifelong financial growth, looking to diversify your income, or creating multiple income streams, understanding the different ways to earn and recognizing the important aspects of growing financially can help you make informed financial decisions. By finding the modern roadmap to financial freedom you can reach from paycheck to portfolio. From trading time for income to leveraging reputation for wealth, the journey of earning money can be broken into distinct stages. Each stage represents a shift in mindset, skills, and opportunities. Let’s break down the stages of earning money and explore your position and how you can increase your financial potential.

1. Earning with Your Time

At the beginning of your financial journey, the most accessible resource you have is your time and the most common and straightforward way to earn money is by exchanging your time for a wage.

This stage is characterized by trading hours for money, often through jobs or gigs that require physical or mental labour.

What It Looks Like:

- Working a 9-to-5 job.

- Freelancing or taking on part-time gigs.

- Delivering food, driving for ride-sharing services, or other task-based work.

Time is the one resource we all have in equal measure—24 hours each day. But how we use it determines whether we struggle financially or build real wealth. The difference between trading hours for dollars and creating scalable income comes down to strategy

Here we can take an example.

Think about a hypothetical person named “James”.

He is a cook in a hotel and his job timing is in the evening from 6 to 11.

He earns Rs/- 500 for an hour.

If someday he works for 2 hours, then he earns Rs/- 1000 for that day. Likewise, he can earn a maximum of Rs/- 2500 per day.

Thus,

He could get immediate income. He can be paid daily or monthly and has a low barrier to entry.

But there is a limit of 5 hours/day to earn and if he is not working then not earning.

Suppose he joins another hotel as a cook with the same wages then also he can earn Rs/- 3500 more if we assume that a person can work only a maximum of 12 hours. Even the loss of a single hour means a loss of earnings for him.

The Pros:

- Immediate income: You get paid for the hours you put in.

- Low barrier to entry: Most jobs require minimal skills or experience.

The Cons:

- Limited scalability: There are only so many hours in a day.

- Burnout risk: Trading time for money can be exhausting and unsustainable in the long run.

- No work = No pay (sick days, vacations, or slow periods hurt).

You can always make additional money, but the time is always limited. The key to financial growth for you isn’t just working harder, it’s working smarter by:

- Charging for value, not hours.

- Building passive income streams.

- Cutting out timewasters that don’t pay off.

You should escape from the time-for-money trap and choose smarter ways to build lasting income and create real wealth and bliss.

Where are you on the earning-with-time spectrum? Are you stuck in the hourly grind, or have you started scaling beyond it?

If you are in this phase, then you should learn the algebra of wealth.

However, this stage is essential for building foundational skills and financial stability, but it’s often the first step toward more advanced earning methods.

And if you want to go beyond then you will need experience and expertise in your field.

2. Earning with Your Knowledge

Once you’ve gained experience and expertise in a particular field, you can transition to earning money through your knowledge. This stage involves monetizing what you know, often by teaching, consulting, or creating value for others.

In today’s digital economy, knowledge isn’t just power—it’s profit. Whether you’re an expert in marketing, a coding whiz, or just good at explaining complex topics, your expertise can become a sustainable income stream. The best part? Unlike physical labour, knowledge-based income scales beautifully.

Monetizing knowledge isn’t just about what you know, it’s about who needs it and how they’ll pay.

That is why your reach should be broad.

What It Looks Like:

- Growing as an advisor or trainer in your industry.

- Creating online courses, eBooks, or tutorials.

- Offering specialized services like graphic design, coding, or financial planning.

Your expertise is a renewable resource. Unlike physical products, you can repackage the same knowledge endlessly.

In the above example if James thinks about monetizing his knowledge (his ability to cook) then he can earn more and can use his time better.

If he does not join another hotel as a cook and monetize his knowledge by starting a course or offering specialized services at big events such as marriages or parties, then his earnings may be great and can overtake his daily job income.

The Pros:

- Higher earning potential: Knowledge-based work often commands higher rates.

- Flexibility: You can often set your schedule and choose your clients.

- Personal fulfilment: Sharing your expertise can be deeply rewarding.

The Cons:

- Requires continuous learning: Staying relevant means constantly updating your skills.

- Initial effort: Building a reputation or audience takes time and dedication.

Earning by your knowledge is a significant leap from trading time for money. It allows you to leverage your expertise to create multiple income streams.

3. Earning with Your Money

We’ve all heard the saying, “It takes money to make money.” But what does that actually look like in practice? While most people focus on earning through their time and skills, the real financial game-changers understand how to put their money to work.

At this stage, your money starts working for you. Instead of relying solely on active income, you begin to generate passive income through investments, businesses, or assets.

What It Looks Like:

- Investing in stocks, bonds, real estate or any valuable asset.

- Starting a business that generates recurring revenue.

- Building a portfolio of income-generating assets like rental properties or dividend-paying stocks.

In the above example if James starts his restaurant chain in his city or broader that means he has invested his money in his new business.

Whichever business model he chooses, here his money starts working for him. However, he must learn to do business also, which may be a new learning for him.

The Pros:

- Passive income: Your money grows even while you sleep.

- Financial freedom: Over time, your investments can replace your active income.

- Scalability: There’s no limit to how much you can earn through smart investments.

The Cons:

- Requires capital: You need money to make money.

- Risk involved: Investments can fluctuate, and there’s no guarantee of returns.

- Patience needed: Building wealth through investments takes time.

This stage is about making your money work smarter, not harder. It’s a critical step toward achieving long-term financial independence.

The deep pockets don’t just work for money, they make their money work for them. Whether through stocks, real estate, or smart business investments, the key is to start early, stay consistent, and let compounding do the heavy lifting.

4. Earning with Your Reputation or Name

The final stage of earning money is leveraging your reputation, brand, or personal name. At this level, your influence and credibility become your most valuable assets.

Your name may carry more value than you think. In a world where trust is scarce and attention is fragmented, your reputation—whether personal or professional—can become one of your most powerful income generators.

From influencers to industry experts, people are monetizing their credibility in ways that go far beyond traditional jobs. Here’s how you can turn your reputation into revenue.

If you convert your name into a brand, then you can

Reduces friction in sales (People buy faster)

charge decoration prices (Brands pay further for credibility)

Creates endless opportunities (Partnerships, speaking gigs, licensing)

What It Looks Like:

- Building a personal brand as an influencer or thought leader.

- Monetizing your reputation through sponsorships, endorsements, or partnerships.

- Creating a legacy business or product that carries your name.

In our example, Chef James can create multiple streams of income. He can-

- Built an audience with free recipes on his blog

- Earns by Sponsored posts

- By Cooking Gear affiliate links

- Signature spice line

- Charge others to teach his methods

The Pros:

- Unlimited potential: Your reputation can open doors to high-paying opportunities.

- Legacy building: Your name can continue to generate income long after you’ve stopped working.

- Creative freedom: You have the power to shape your brand and message.

The Cons:

- High responsibility: Maintaining a reputation requires consistent effort and integrity.

- Vulnerability: Your reputation can be damaged by mistakes or controversies.

- Time-intensive: Building a strong personal brand takes years of dedication.

Money comes and goes, but a sterling reputation keeps paying for decades—whether through book royalties, referral fees, or premium consulting.

Earning with your reputation is the pinnacle of financial growth. It’s about turning your influence into a sustainable source of income and leaving a lasting impact.

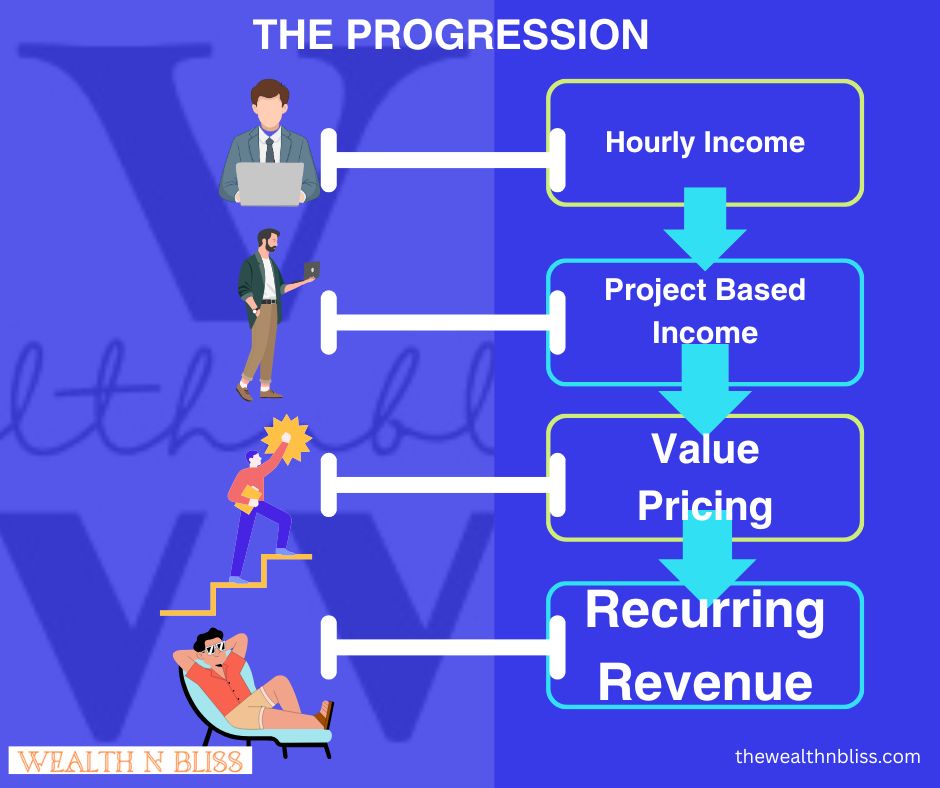

What could be the action plan-

To get better results we must have a plan. We all know the important aspects of lifelong financial growth. We also know the right investment always promotes financial growth.

But the roadmap should be individual and must be matched with your ability to grow. A person aged 60 years may not have a strong desire to earn more, likewise, at an early age, education is also an important aspect of life.

Thus, I tried to divide this journey into different phases to prepare a roadmap to achieve real wealth and bliss, but everyone should make this plan according to the situation. But first you need to understand where you are.

Phase 1 (0-6 months):

In this you are leaving on your paycheck then you are in this phase. Here first you should audit your current income and try to identify how much money you can save. Then invest these savings in polishing your skill.

In the above example, “James should invest his savings to polishing his cooking skills.

Before escalating to the next phase, he must be skilful so he can monetize his skill in a better way.

After getting confidence you can create your first “productized” offer

Phase 2 (6-12 months):

In this phase, the profit should be reinvested into income-generating assets. For example, James can start a blog or vlog to create an audience.

You also should systemize reputation-building activities. You can organize some events where you can advertise your product or services, or you can also join any preorganized activity.

If you have built your name as a brand then you can go to the next phase.

Phase 3 (12+ months):

In this phase, you must shift to overseeing rather than doing. Here you will have to distribute your work to your colleagues.

Here money and reputation work for you while you explore new opportunities.

“Wealth isn’t about having money, it’s about having choices.”

The journey of earning money is a progression from trading time to leveraging knowledge, money, and ultimately, reputation. Each stage builds on the previous one, offering greater freedom, flexibility, and financial rewards. While not everyone will reach the final stage, understanding these phases can help you identify where you are and where you want to go. Whether you’re just starting out or already building your legacy, the key is to keep growing, learning, and adapting. After all, the way you earn money is a reflection of how you choose to live your life.